Why Global Buyers Are Choosing Coconut Husk Exporters in India

India is one of the world’s top coconut producers, playing a key role in the global supply of coconut and its byproducts. States like Tamil Nadu, Kerala, Karnataka, and Andhra Pradesh have large coconut plantations that generate millions of tons of coconut husks every year. What was once considered waste is now a valuable raw material in international markets.

As a leading coconut husk exporter, India provides eco-friendly and sustainable products to buyers across the globe. The Coconut Development Board and government-backed export schemes actively support this growing industry. Thanks to abundant raw materials, skilled labor, and strong demand, India continues to grow as a global hub for coconut husk products.

This article explores how exporting coconut husk products is not only a lucrative business but also aligns with global green trends, driven by rising demand in the US, EU, and beyond.

India’s Cocopeat & Coir Chips Export Market is Booming Globally

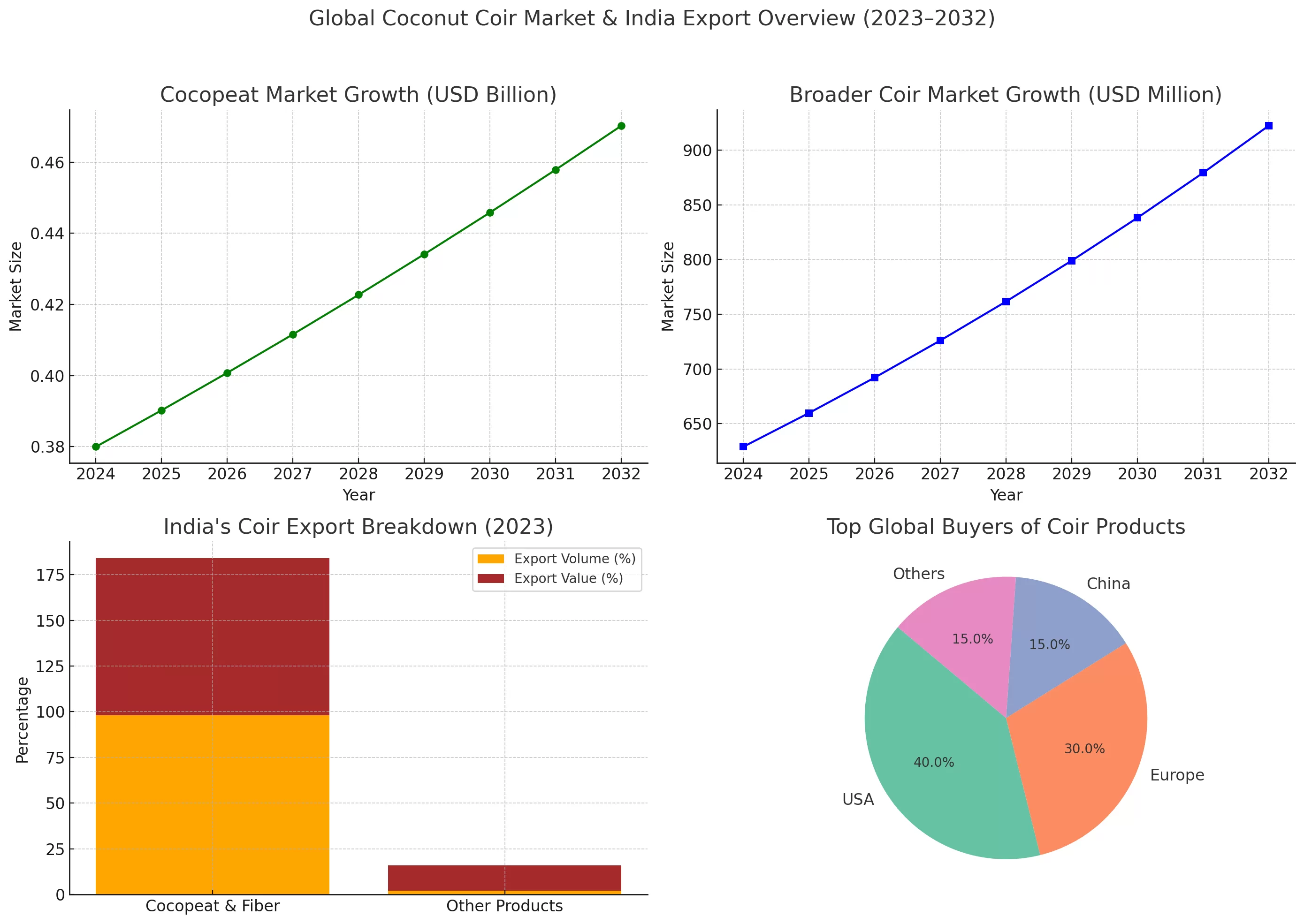

Global demand for coconut coir products has been on a steady rise, underpinned by trends in sustainable agriculture and gardening. The cocopeat market alone was valued around USD 0.38 billion in 2024 and is projected to reach USD 0.47 billion by 2032 (about 2.7% CAGR).

The broader coir market (including fiber and related products) is expected to expand from roughly USD 629 million in 2024 to over USD 914 million by 2032, growing ~4.9% annually.

These figures reflect strong international appetite for natural, peat-free growing media and fibers.

India is exceptionally well-positioned to serve this demand. According to India’s Ministry of Commerce data, India exported about 1.058 million tons of coir products in 2023, earning roughly US$292 million.

Notably, cocopeat (coir pith) and coir fiber made up over 98% of export volume (and 86% of export value)

– underlining that raw husk derivatives are the backbone of India’s coir exports. Key buyers are in Europe and the USA, as well as China, which together account for over 85% of global demand for these products.

In fact, the United States is the single largest importer of cocopeat by volume, followed by countries in Europe and Asia.

This high demand is driven by multiple end-use industries and trends discussed below.

Several factors are fueling this boom: a surge in organic farming and horticulture, the expansion of hydroponics and indoor gardening, and a global shift toward sustainable materials. In Europe, for example, environmental policies are creating new opportunities – the UK government has moved to ban retail sales of peat moss by 2024, pushing growers to seek alternatives like coconut coir.

( source- theguardian.com )

Likewise, American gardeners are increasingly turning to coco coir as a replacement for traditional peat-based potting soil

( source- plantbest.com )

Whether it’s commercial greenhouse growers in the Netherlands or home gardeners in California, buyers are seeking cocopeat, coir fiber mats, and coir chips for their excellent growing properties and eco-friendly image. This global demand trajectory paints a promising picture for Indian exporters ready to supply quality coconut husk products.

Coconut Husk: A Biodegradable Alternative to Plastic

As plastic pollution rises globally, industries are turning to natural, eco-friendly alternatives — and coconut husk products are leading the way. Derived from a renewable source, coir fiber, coco peat, and coir pith are fully biodegradable and decompose without harming the

By replacing synthetic materials, coconut husk products offer a green solution for businesses seeking sustainability. As a trusted coconut husk exporter from India, Greglo helps global partners shift toward a cleaner, plastic-free future.

Sustainability: Turning Coconut Waste into Green Gold

– cocopeat offers a sustainable, renewable growing medium that is helping to replace environmentally damaging peat.

One of the strongest selling points of cocopeat and coir products is their sustainability. Coconut husk by-products were once discarded or left to pollute; now they are repurposed into useful materials, literally turning waste into wealth. Unlike peat moss – which is mined from fragile bog ecosystems and is non-renewable – coconut coir is a renewable resource harvested from abundant coconut palms. Recycling husks into cocopeat prevents waste and provides an alternative to stripping peat bogs (which are vital carbon sinks).

International buyers and policymakers recognize this: coir is highlighted as a top sustainable alternative to peat in gardening and soil products.

From a business perspective, the eco-friendly appeal of coir products gives Indian exporters a marketing edge. Companies can legitimately brand cocopeat and coir fiber exports as “natural,” “organic,” and “earth-friendly.” This resonates strongly in Western markets where consumers and businesses are willing to pay a premium for green products. Moreover, coir products are biodegradable and compostable. A coir erosion-control mat or grow bag will decompose harmlessly, unlike synthetic materials. Using coconut husk by-products also supports a circular economy – it creates rural employment and additional income for coconut farmers while reducing environmental pollution. All these factors make coconut husk products doubly attractive: economically smart and environmentally responsible.

Finally, there’s a compelling carbon story here. By exporting coir-based goods, India is effectively exporting a solution that helps other countries reduce carbon footprints (by avoiding peat usage or synthetic fibers). For the global community increasingly focused on sustainability, this “green” positioning of coir enhances its demand. In summary, the sustainability and economic appeal go hand in hand – what’s good for the planet is proving good for business.

Cocopeat, Coco Cubes, and Coir Chips from India: Products & Uses Driving Global Demand

Coconut husk yields multiple products, each with specific uses in international markets. Indian exporters should focus on the following in-demand husk products:

- Cocopeat (Coir Pith): Cocopeat is the spongy, peat-like material from husk fiber processing. It is prized as a soil-less growing medium and soil conditioner. Cocopeat can absorb and retain large amounts of water while still providing aeration to roots. It has become extremely popular in organic farming, greenhouse nurseries, hydroponic systems, and home gardening as a peat moss substitute.

( source- businessresearchinsights.com )

For instance, compressed cocopeat bricks are used by gardeners – just add water and they expand into nutrient-rich growing media. The global surge in hydroponics and organic vegetable cultivation heavily drives cocopeat demand. Additionally, landscaping and golf course companies use cocopeat for soil improvement, and it’s even used as a natural absorbent in industrial clean-ups. This versatility makes cocopeat the star product among coir exports (over half of India’s coir export value comes from coir pith alone). - Coco Cubes: Coco cubes are compact, blocky chunks of coconut husk created by cutting coarser husk fibers into uniform cube shapes. They offer a unique combination of water retention and aeration, making them ideal for hydroponic systems, nurseries, and indoor gardening setups. Unlike loose coir or chips, the cubed structure provides greater stability in grow bags and pots, helping support root development in crops like capsicum, cucumber, and leafy greens.

Many growers mix coco cubes with cocopeat to create a balanced grow medium that retains moisture without suffocating roots. This blend is particularly effective for long-term crops in greenhouses or vertical farms. In landscaping and gardening, coco cubes serve as an attractive, natural mulch that helps retain soil moisture, reduce weed growth, and improve soil texture over time.

For exporters from India, coco cubes are a smart value-added product — transforming coarse husk into a consistent, easy-to-handle medium favored in Europe, the Middle East, and North America. Their demand is growing fast, especially with the rise of soil-less farming and eco-conscious gardening trends.

- Coir Chips: Coir chips are small chunks of coconut husk, roughly cut into pieces. These chips are increasingly sought after in nurseries and hydroponics. Coir chips mixed into potting soil improve drainage and aeration – they are excellent for cultivating orchids, anthuriums, and other tropical plants that need chunky, well-aerated media. Hydroponic growers use coir chips in grow bags and containers to support crops like tomatoes and strawberries, often in combination with cocopeat (the chips provide structure and prevent compaction). Home gardeners in the US/EU also buy coir chips for mulching (they suppress weeds and conserve moisture around garden beds) and as a decorative, natural landscaping material. In erosion control, larger coir chunks are packed into “coir logs” for stream bank protection. For Indian exporters, coir chips are a high-margin product since they capitalize on coco husk material that’s coarser than pith – essentially another form of waste utilization. Their usage in niche horticulture is rising in tandem with cocopeat.

Each of these products taps into the global shift toward organic and sustainable growing. By producing cocopeat, fiber, and chips to the quality standards international buyers expect (e.g., low EC – salt content – for cocopeat, uniform grading for chips, etc.), Indian SMEs can cater to a wide array of applications from commercial agriculture to hobby gardening. The diversity of uses – spanning farming, gardening, landscaping, and even industrial uses – provides a broad and resilient market for coconut husk exports.

International Market Opportunities: B2B and B2C Channels

Indian coconut husk product exporters can target both B2B and B2C segments in international markets, each with its own approach:

- B2B Opportunities: Bulk buyers of cocopeat and coir fiber are plentiful. These include commercial growers, import distributors, and manufacturers abroad. For example, large greenhouse operations in Europe import container-loads of compressed cocopeat blocks to use as growing substrate. Soil manufacturing companies in the US blend cocopeat into bagged potting mixes sold under their brands. There is also significant B2B demand for coir fiber rolls and mats from landscaping and construction suppliers (for erosion control and landscaping projects). Indian exporters can establish relationships with such businesses or through international traders. Key markets like the USA, China, the Netherlands, UK, Spain, and South Korea consistently import huge quantities of cocopeat.

(source- exportimportdata.in )

Many importers prefer to source from India due to the high volume and reliability – India is the #1 cocopeat exporter globally by volume.

By attending trade fairs (e.g. horticulture expos in Europe) or using B2B platforms, Indian suppliers can secure contracts for large orders. The volume-centric B2B route often means lower per-unit prices but high consistency and scale. It’s worth noting that over 900 Indian exporters are already active in cocopeat exports, indicating a robust ecosystem where even SMEs can find a niche supplying foreign businesses. - B2C Opportunities: With the rise of e-commerce and global retail, some coconut husk products can also be sold direct-to-consumer in overseas markets. This typically involves more branding and packaging, but can yield higher margins. For instance, an exporter can package 1-kg briquettes of cocopeat or DIY gardening kits with coir pellets and sell them on Amazon in the US or EU. There’s a growing community of eco-conscious home gardeners who look for coco coir bricks for their houseplants or vegetable gardens. Retail chains and garden centers in Europe are also stocking peat-free compost and coir-based potting soils as consumer awareness grows. An Indian company could partner with such retailers or launch its own brand targeted at the B2C gardening segment. Similarly, coir doormats, coir rope crafts, or coconut fiber planters can be marketed as sustainable home products. While entering B2C markets requires marketing savvy and possibly local presence or fulfillment partners, it offers the chance to build a brand loyalty. The success of some Indian cocopeat product brands abroad shows this is doable – for example, coir hanging baskets from Kerala or Tamil Nadu find their way into European garden stores. In short, B2C channels reward innovation and branding: selling not just raw material, but a finished product experience (like an “organic home garden kit”) to eco-minded consumers.

Whether B2B or B2C, the underlying demand drivers are the same – a preference for sustainable, effective growing materials and natural fibers. Indian exporters can choose one route or a mix (for instance, selling bulk cocopeat to large buyers while also retailing a branded version online). What’s important is to understand the target market’s needs. A B2B client might care most about consistency, volume, and price; a B2C customer might be attracted by convenience, packaging, and the story of the product (e.g., “ethical, made in India, supporting rural communities”). Fortunately, the market pie is large and growing, so new entrants have room to carve out their customer base.

Success Stories: Indian Exporters Leading the Way

India’s coconut fiber industry is full of examples proving that exporting husk products can be a thriving venture. One standout story is Green Globe Exports India PVT LTD (Greglo), a Pollachi -based startup founded by entrepreneur Prabhakaran Kaliappan . Prabhakaran recognized the potential of cocopeat early on and began upcycling coconut husk waste into cocopeat bricks, grow bags, and coir pots. Today, these products worldwide and boasts an annual turnover of ₹ 25 crore (~USD 3 million).

“Tamil Nadu is the largest supplier and producer of coco peat in India. The market for it is mainly international, especially in European countries where the soil fertility is quite low,” notes Prabhakaran, highlighting how he tapped into Europe’s need for soil improvers.

From a one-man startup in 2014, his company scaled by focusing on quality and novel products (like biodegradable coir planters) that appeal to global buyers. This “waste to wealth” startup story has inspired many others in South India to look at cocopeat as a high-growth export business.

Tamil Nadu’s Coimbatore-Pollachi belt in particular has become a cocopeat export hub, with dozens of factories compressing coir pith into blocks for shipment. Thanks to an abundance of coconut husks in the region and entrepreneurial drive, Pollachi is often called the cocopeat capital of India.

Similarly, Kerala, with its century-old coir industry, has seen traditional coir manufacturers reinvent themselves for the global market. For example, long-standing coir cooperatives in Alappuzha (Alleppey) that once made only rope and mats are now exporting coir geotextiles and garden substrates to Europe and the Middle East. The Kerala State Coir Corporation and Coirfed have innovated products like coir-based erosion control blankets that meet international standards, finding buyers in countries looking for green erosion solutions. These success cases underline a key point: diversification and value-addition are helping Indian companies earn more from the humble coconut husk. Instead of selling just raw fiber, they are creating finished products (molded pots, mats, grow-bags) that command better prices abroad.

(source- coconutcommunity.org )

It’s not just the southern states – entrepreneurs from Andhra Pradesh, Karnataka, and others are also jumping in. An MSME in Andhra’s West Godavari district, for instance, scaled up a coir fiber export business supplying Chinese mattress manufacturers.

The coir industry across India employs over 550,000 people (many in rural areas)

(source-kinaracapital.com)

, and export growth directly benefits these communities. In 2020-21, India’s coir exports hit an all-time high of $487 million, a 37% jump from the previous year.

This boom year, driven by soaring overseas demand (partly due to a pandemic gardening craze), showcased the high growth potential when supply chains and marketing align. Although prices and volumes can fluctuate year to year, the long-term trend is clearly upward. Sri Lanka may be a strong competitor (it’s the world’s largest coir exporter by value historically

, but Indian companies are rapidly expanding their footprint, backed by abundant raw material and innovation.

The government, via the Coir Board of India, has also bolstered this sector by providing training, R&D, and export promotion. Initiatives like the Export Market Promotion Program and Coir Vikas Yojana help SMEs upgrade technology and participate in international trade shows. This supportive ecosystem, combined with pioneering entrepreneurs and rising global demand, has created a fertile ground for new export success stories to emerge. The experiences of successful exporters highlight that with the right approach, a small startup can grow into a multi-crore business by catering to the world’s appetite for eco-friendly coir products.

Getting Started: Export Tips for Indian SMEs and Startups

For Indian small businesses and startups looking to venture into exporting cocopeat, coco cubes, or coir chips, here are some general steps and best practices to begin on the right foot:

- Research Your Market and Niche: Start by identifying where your product is needed most. Is it the hydroponics farms in Europe, garden centers in the USA, or maybe erosion control contractors in Australia? Study international market trends and demand – for example, know that Europe is seeking peat-free substrates, the US has a big home gardening market, and China imports coir fiber for manufacturing. Focus on a few target countries and learn about their usage of coir products. This will help tailor your product (e.g. low EC cocopeat for professional growers, attractive retail packaging for consumer gardeners).

- Ensure Quality and Standards: International buyers will expect consistent quality and compliance with standards. For cocopeat, that means proper washing/ buffering to reduce salt content, correct moisture level, and standardized block sizes. For coir fiber, ensure it’s properly cleaned and graded (length, impurity content) as per buyer needs. Quality certificates or lab tests (for properties like pH, EC, etc.) can boost your credibility. Also, be mindful of phytosanitary requirements – since these are organic products, some countries require treatment or certification that they are free from pests or pathogens. Investing in good machinery for processing and packing will pay off in meeting export-grade specs.

- Build Relationships and Find Buyers: Networking is key in the export business. Leverage the Coir Board’s export promotion events, attend international trade fairs (like horticulture expos, agricultural shows), and list your products on B2B marketplaces such as Alibaba, Indiamart Global, etc. Digital marketing can also help – maintain a professional website showcasing your cocopeat/coir products and their applications, and use LinkedIn or industry forums to connect with potential buyers. Often, new exporters start by sending samples to interested buyers. Be proactive in reaching out to importers/distributors who deal in garden supplies or natural fibers. Remember that buyers value reliability; even as a startup, if you communicate clearly and deliver as promised, you can win contracts over larger competitors.

- Leverage Government and Industry Support: Tap into the resources offered by Indian authorities and associations. The Coir Board of India offers training programs and can guide you on export documentation, standards, and even provide market intelligence. There are schemes for MSMEs that can help finance modern equipment (e.g., Coir Udyami Yojana) and export incentives you should be aware of. Being part of associations or boards gives credibility and keeps you updated on any policy changes (for instance, duty benefits or new regulations in target countries). Export-oriented units in coir might also get subsidies or tax benefits – explore these to keep your costs competitive. Essentially, don’t walk alone; use the ecosystem that’s there to support new exporters.

- Start Small, Comply with Logistics: When you receive your first international orders, it’s wise to start with manageable volumes to ensure you can maintain quality and timely delivery. Learn the export logistics basics: booking freight (coir products are bulky, so optimize packing and consider sea freight costs), proper documentation (commercial invoice, packing list, Bill of Lading, phytosanitary certificate if needed, etc.), and any customs procedures. Ensure your products are packaged to withstand long transit (for example, shrink-wrapping cocopeat pallets, or using UV-resistant bales for fiber). Many exporters partner with a good freight forwarder or export agent initially to handle shipping details. Over time, you’ll become more familiar and can scale up shipments confidently.

Focus on USP and Branding (for B2C): If you plan to enter retail markets or launch a brand, think about your Unique Selling Proposition. It could be highlighting that your cocopeat is sourced from a specific region known for quality, or that your product is 100% organic and eco-friendly (backed by certifications like OMRI for organic use). Invest in attractive packaging and perhaps some storytelling about the product’s origin (consumers love a good origin story, e.g., “Made from Kerala’s finest coconut husks”). Even for B2B, a clear brand can help – buyers often prefer dealing with a known name. Build a brand that stands for quality coir products from India.

By following these steps, Indian SMEs can gradually navigate the export process without getting overwhelmed by regulations or competition. In essence: know your market, maintain quality, network diligently, and utilize support systems. The path from a local coir unit to an international supplier is well-trodden by many; with careful planning and persistence, even newcomers can succeed.

Harnessing the Green Export Opportunity

Exporting coconut husk products offers India a dual advantage – economic gains and environmental benefits. As the world pivots toward sustainable materials, cocopeat, coir cubes, and coir chips have emerged as ideal solutions, replacing less sustainable alternatives in farms, gardens, and industries globally. For Indian entrepreneurs, this represents a green business opportunity: one where profits grow hand-in-hand with positive ecological impact. The strong international demand in the US, EU, and other markets is a trend likely to continue as organic cultivation and eco-friendly practices become mainstream. India’s natural endowment of coconuts, combined with decades of coir craftsmanship, gives our exporters a competitive edge in this arena.

In tapping into this opportunity, many Indian companies have built inspiring success stories – from small-town coir mills scaling up to multi-crore exporters. Their journeys illustrate that with innovation and quality, even a product as humble as coconut husk can command global appeal. Going forward, supporting more SMEs and startups to enter the export fold will not only boost rural employment and income (truly turning “Waste to Wealth”), but also strengthen India’s position as a world leader in sustainable products. For potential exporters reading this, the time is ripe to seize the coconut husk export boom – a venture that is lucrative, scalable, and contributes to a greener planet.

Indian businesses that ride this wave will be doing more than just commerce; they will be ambassadors of sustainability, delivering eco-friendly Indian cocopeat and coir products to the world. In return, they can build thriving enterprises that stand the test of time. Exporting coconut husk products is indeed a green business opportunity – one that holds the promise of profit with purpose. By leveraging our country’s strengths and staying attuned to international trends, India can continue to grow as a trusted supplier of coir-based solutions, planting the seeds for long-term success in the global marketplace.

Sources: Recent industry reports and news on coir exports and global market trends were referenced to provide up-to-date insights. Key statistics on India’s coir export volumes and revenues were drawn from the Ministry of Commerce data as reported by the International Coconut Community.

(source-coconutcommunity.org)

Cocopeat market size and growth forecasts are based on 2024–2032 projections.

(businessresearchinsights.com)

Information on global importer markets and India’s top export destinations (USA, EU, China, etc.) were taken from export databases

(source-exportimportdata.in).

The sustainability context, including the UK peat ban, is supported by environmental reports

We also included insights from real-world case studies, such as the inspiring journey of Greglo, a coconut husk product exporter based in Pollachi, whose success has been featured in multiple media outlets.

Together, these examples and data points paint a clear picture:

🌍 The global demand for sustainable coir-based products is real, growing, and full of opportunity.

Whether you’re an exporter, grower, or eco-brand, now is the time to tap into this green wave — and with the right strategy, India is the perfect place to lead it.

Ready to Tap into the Global Demand for Coconut Husk Products?

Join the sustainable export movement with Greglo, one of India’s emerging leaders in eco-friendly coir solutions.

🌱 Whether you’re a bulk buyer, retailer, or sustainability-focused brand, we’ve got the right products, packaging, and support to grow your business.

📩 Contact us today to:

-

Get a custom quote

-

Explore our product catalog

-

Learn about packaging, private labeling, and logistics